The worldwide foreign exchange industry was estimated by the financial market to be worth US$805 billion in 2023. In terms of the financial level, that is a big amount to consider. It makes sense, then, that people want to learn how to become forex brokers so they may profit from all the transactions, trends, and foreign exchange money.

Everyone can make money with stock trading and trends in the foreign exchange market as long as their plans are well-developed and executed. Because of the UK’s robust and expanding economy, forex trading is distinct from traditional trade and a lucrative venture. Thus, the response to the question of how to become a forex broker in UK is straightforward and profitable.

This article provides you with a thorough overview of how to become a forex broker, covering all the necessary techniques, approaches, requirements, marketing, and locating the top forex brokers.

We will also go over how to pick a forex exchange company, whether or not you need forex VPS hosting, and how to start a forex company, draw customers, and operate a profitable forex broker business. So without further ado, let’s dive right into how to start a profitable forex trading company and become a forex broker.

First things first:

“What is a Forex Broker?”

The goal of forex trading, which involves purchasing and selling foreign exchange, is to increase profit margins by taking advantage of variations in the value of various national currencies. Now think of a forex broker as a provider of financial services. This business serves as a middleman for buyers and sellers of foreign exchange.

A forex broker gives traders access to a platform where they can buy and sell currencies at current market rates. The total turnover in the forex market is determined by the profit margins that traders make. To provide you with a quick overview of the global foreign exchange market, trillions of dollars are exchanged every day.

Forex Broker Business Models Used in the United Kingdom

UK forex brokers utilise a variety of business structures for forex brokerage. The following are the top business models:

1. Model of Agency

The broker works as an agent for its clients under the agency model, commonly referred to as the A-book model. In this instance, the broker works directly with liquidity providers (LPs) in the interbank market to match orders.

Features:

- The cost of the agency model is clear.

- There are now fewer conflicts of interest.

- Its spreads are likewise smaller.

2. Model of the Market Maker

The broker takes the opposite side of the trade from its clients under the market maker model, also known as the B-Book model.

Features:

- It provides quicker order fulfilment.

- Order fills can be controlled with the B-Book.

- It also offers a wide range of goods and services.

3. Model Hybrid

A hybrid model, as its name implies, combines elements of the A-Book and B-Book models. The broker in this model combines aspects of the market maker and agency models.

Features:

- It provides both models’ advantages.

- It can be customised to meet the unique requirements of the broker’s customers.

4. Deal-Free Desk Configuration

The currency orders are the basis for the No Deal Desk (NDD) paradigm. In this instance, the orders are executed straight to the external liquidity. The brokers have no control over the foreign exchange during this process.

Features:

- It is a quicker and simpler method of getting into the currency market.

- It can also make use of the provider’s knowledge and technology.

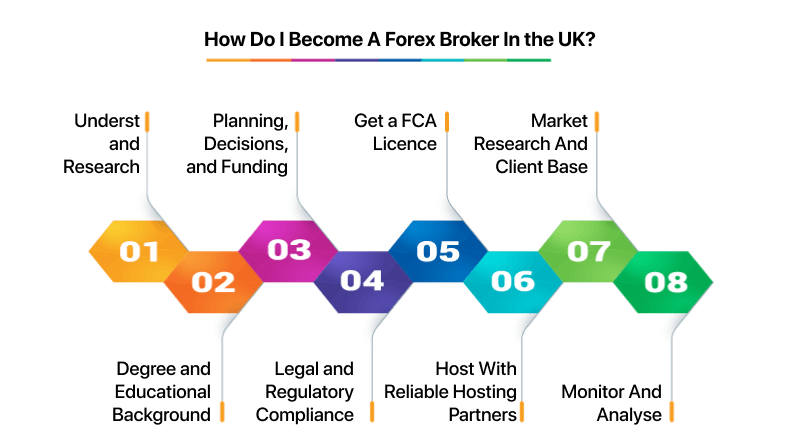

How Do I Become A Forex Broker In the UK?

Forex trading in the UK is a bit different from the others. The overall transactions and process of forex trading in the UK are handled by the Financial Conduct Authority (FCA), which allows traders to buy or sell stocks. To be able to work as a forex broker in the UK, you must be legally authorised by the FCA.

One must be able to adhere to all the rules and regulations laid down by the FCA for the smooth operation of forex brokers. After learning a little bit about managing and handling forex trading, let’s go to detailed instructions on how to become a forex broker in the UK using simple and secure techniques. Here are the detailed step-by-step instructions for the process.

1. Understand and Research

The UK is unlike other countries when it comes to foreign exchange transactions. The rules, background on monetary investments, and having deep knowledge about forex brokers in the UK are essential. You must have done good research on it and understood it.

2. Degree and Educational Background

To become a forex broker in the UK, you need to have a degree in the relevant field of education. The degrees can be pursued in finance, business, or economics, or they can pursue certifications like CFMP or CMT. Additionally, skills like expertise in market trends, handling risks, and knowing the statistics of trading platforms will surely help one as a forex broker.

3. Planning, Decisions, and Funding

Once you have a good understanding of the forex market and the required degree, the next step is to make a plan. You need to define your target, USPs, and marketing strategies, then choose a forex broker model. And lastly, weigh all your options related to the financial constraints. To maintain the necessary investment, the capital required may be approximately 125,000 EUR or 750,000 EUR, depending on permissions.

4. Legal and Regulatory Compliance

Read thoroughly all the policies and documentation laid out by the FCA. To smooth the process and get straight to the legal documents, you can also consult with legal professionals. If you wish to become a forex broker, you should implement anti-money laundering (AML) and Know Your Customer (KYC) policies.

5. Get a FCA Licence

No one can work legally as a forex broker without an authorised FCA licence. Collect all the required documents, have your identity and KYC ready, and apply for an FCA licence. Once your application is submitted, you will need to go through an FCA review process, and the results of the review will determine whether you get the licence or not.

6. Host With Reliable Hosting Partners

Investing in a secured technology provider is essential. You need a reliable web hosting provider to understand your forex hosting model and its requirements. Choose a hosting provider that ensures you get the highest customisation features along with intense scalability for the website’s growth.

7. Market Research And Client Base

Forex brokers in the UK need to have a strong clientele that can engage users to buy or sell stocks and initiate trading patterns. Once you receive the licence from the FCA, all you need to do is look for potential customers and start your forex broker business seamlessly.

8. Monitor And Analyse

After setting up the legal procedure and getting the forex broker licence, you need to monitor the brokerage patterns and its stats and analyse the weak points. As a forex broker, you need to provide exceptional customer support to all your clients and help them by providing educational materials.

What Crucial Competencies Are Needed To Become A Forex Broker?

How can I work as a foreign exchange broker? To initiate your forex firm, you must acquire specific skills and target your development process. These improved skills will make you a top forex broker in the UK and you can leverage the foreign exchange returns easily.

- Financial And Analytical skills

- Quantitative And Analytical Skills

- Technical Skills

- Regulatory And Compliance Skills

- Communication And Business Skills

- Problem-Solving Skills

- Adaptability And Learning Agility

What Educational Stream Helps You Become A Forex Broker In the UK?

To be a well-versed forex broker in the UK, you need to have a relevant degree that can define your financial understanding. Some of the popular streams to choose as a UK forex broker are as follows:

- Finance

- Business

- Economics

- Quantitative Mathematics

- Computer Science

- Accounting

- Legal Aspects Law

- Certification Courses (CFMP or CMT)

To enhance your educational background, you can also consider internships and work experience. Work at financial institutions, investment firms, or forex brokerages that can give you a deep understanding of foreign exchange patterns.

Process to Obtain Forex Broker Licence in the UK

Each jurisdiction sets its own procedure to obtain a forex licence; to follow the legal procedure, make sure you check each policy and read it thoroughly. Here’s the general guide to obtaining the licence from FCA.

- The FCA regulates all forex trading done in the UK. So each jurisdiction is under the control of the FCA. You need to choose your jurisdiction of operation and then decide on the type of licence you want to obtain.

- The next step is to register your forex company and open a business bank account specifically for business operations related to forex. Make sure your chosen bank is regulated by the FCA terms only.

- Contact the FCA authorities and make a list of all the required documents. File all the documents and make a proper application.

- Once the application is ready, submit it along with the application fee to the FCA through their online portal.

- Now wait and rest as the FCA reviews the application and sends you its approval.

- After your approval from the FCA, you will be issued a licence from them and thereby, you can offer forex broker services to your clients.

Which licence types are available for forex brokers?

The type of forex broker licence depends on the services you offer and your business style. In the UK, you’ll find two major licence types operating; they are as follows:

1. Full Authorised

A full authorization licence makes it possible to provide a variety of CFD and FX services.

2. Restricted Licence

Restricted authorization licences limit services to particular goods or undertakings.

UK Forex Broker Advantages

- The UK forex market has a huge client potential base and due to the FCA’s strict regulations, the market has the highest trust authority.

- In the UK, London, being one of the leading technology hubs in the world, has the best access to advanced trading platforms, liquidity providers, and skilled professionals.

- The UK also supports client trading, bid-ask spreads, and commissions with high scalability.

- The tax burden in the UK is also favourable, as the tax treatment is low on financial services, leading to hefty profit margins.

Top Forex Brokers FAQs

What is a forex broker?

A forex broker is a mediator between forex traders and the interbank market. Forex brokers offer financial services and a platform where buyers and sellers perform foreign currency trades.

What does a forex broker do?

Apart from being a mediator and providing a platform, forex brokers also help in executing foreign exchange orders, tracking trade performance, providing direct market access (DMA), quoting currency pair prices, and providing leverage to buyers and sellers to maximise profit.

How to start a forex business from scratch?

To build your forex business from scratch, you need to have good control over the trading patterns of the foreign exchange. In the above article, I have mentioned a step-by-step guide where you can start your forex business easily and effortlessly.

Is it hard to be a forex broker?

Absolutely not. Being a forex broker, though, is not for everyone. A person who has a good understanding of forex trends, is well-versed in legal regulations, is good at communication, and has a strong decision-making process can surely try.

Being a forex broker requires your skills and analysis to be accurate. So with proper information, you can start your forex broker business as well.

What is a broker in forex?

In forex, a broker is an intermediary who connects buyers and sellers of currencies. They act as a bridge between individuals or institutions looking to exchange one currency for another.

If you’re wondering how to start a forex brokerage, keep in mind that doing so necessitates ongoing adjustments to the foreign exchange market. The profit potential is increased by currency volatility and constantly shifting conditions.

The volume of funds traded makes becoming a forex broker in the UK highly competitive. The forex brokers in the UK compete fiercely with one another. To gain traction in the market, a novice must have a well-thought-out plan from the beginning.

You may use timely, high-quality customer care to build your reputation as a trustworthy forex brokerage company and as a potent marketing tool.

In addition, services ought to be excellent in risk management, finance, trading desk operations, compliance, and client support. Consequently, the procedure of becoming a forex broker in the UK can be made simpler with a cooperative approach, understanding of forex trading, and commitment to the services.